Fine-Grained Risk Assessment of AEB in Urban Settings

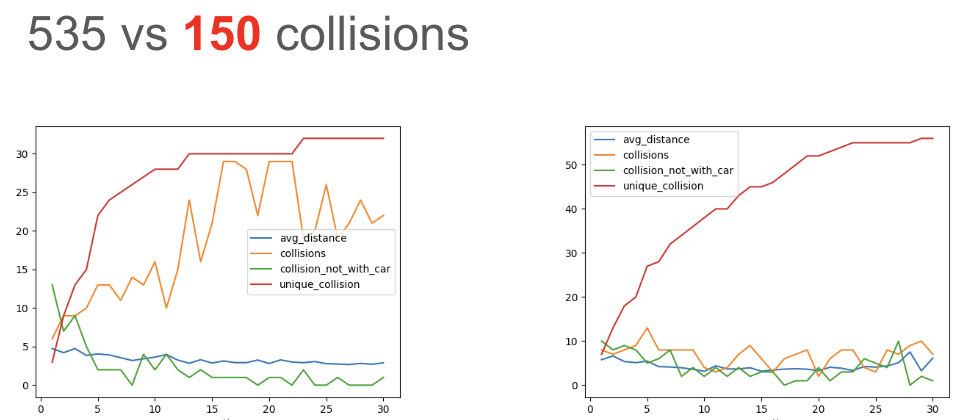

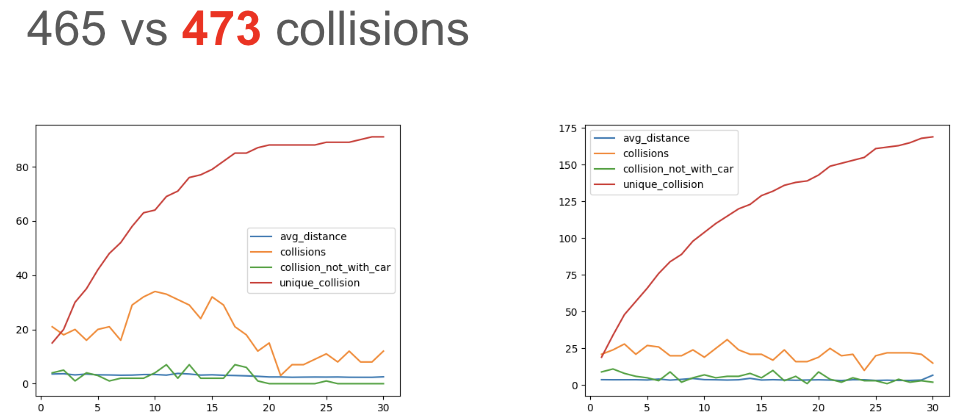

Tempero conducted a detailed assessment of Automated Emergency Braking (AEB) in two urban settings with varying traffic densities, td1 and td2. We used around 12,000 optimization-driven virtual simulations to evaluate AEB’s effectiveness.

Findings

Setting td1: AEB significantly reduced the number of collisions.

Setting td2: AEB had minimal impact on collision rates, indicating its limited utility with this traffic density.

Implications

These results demonstrate Tempero’s ability to provide fine-grained risk assessments tailored to specific contexts, contrasting with public global statistics like the Insurance Institute for Highway Safety (IIHS) study on the “Real-world benefits of crash avoidance technologies.” The IIHS data relies on past insurance claims and provides average results that do not account for the nuances of different real-world contexts. This precision is crucial for the future of new mobility, which will involve vastly different driving contexts—from poorly augmented environments to richly augmented ones (e.g., V2I or V2V support). Traditional post-accident claims data analysis is insufficient for upcoming mobility challenges, as it fails to adapt to the diverse and evolving scenarios that connected and automated vehicles will encounter.

crash avoidance technologies – HLDI-IIHS July 2023

This type of fine-grained risk analysis is pivotal for the auto insurance industry, enabling accurate assessment of the value of automation (ADAS/AV) based on specific usage contexts. Insurers can better price premiums, and end-users can ensure their vehicle’s capabilities are factored in. Tempero’s PHYSD (Pay-As-Your-System-Drives) component is integral to providing these insights.

Conclusion

Tempero’s advanced simulation capabilities offer a more precise and context-sensitive evaluation of safety technologies, empowering stakeholders to make informed decisions based on detailed risk assessments. This approach not only aids automated vehicle companies in achieving higher safety and reliability standards but also provides insurers with valuable insights for accurate premium pricing. Additionally, Tempero’s expertise supports regulators in defining and refining test scenarios, promoting safer and more reliable automated mobility operations. Through fine-grained risk analysis, Tempero is paving the way for responsible AI solutions in the evolving landscape of new mobility.

Contact Us

For more information on how Tempero can assist in your specific needs, please visit our Contact Us page.